Saving money from your salary may seem difficult, but with the smart habits, it becomes a lifestyle that leads to true financial freedom. Here are 6 effective ways to help you save effectively:

Build a Budget to Manage Expenses

Start by identifying your income and expenses. Allocate your salary into:

- **Needs** (e.g., rent, food)

- **Wants** (e.g., entertainment)

- **Savings**

Use tools like a budgeting app such as YNAB to stay organized. This helps you understand your finances and make changes.

Prioritize Savings Before Spending

Before spending on anything else, transfer a portion of your income into a savings or investment account. Automating this process ensures you prioritize savings. Even saving 10% monthly can make a big difference.

Cut Unnecessary Expenses

Review your monthly spending and look for areas to reduce costs. For example:

- Reduce dining out

- Pay off high-interest credit cards

- Use bikes instead of driving

Small changes lead to large savings.

Set Clear Savings Goals

Clarify what you're saving for: short- or long-term goals. Break large goals into smaller targets so you can track your progress.

Use the 50/30/20 Rule

This popular method divides your income:

- **50% for Needs**

- **30% for Wants**

- **20% for Savings or Debt**

You can adjust the percentages based on your lifestyle and income.

Review Your Budget Monthly

Check your income, expenses, and savings each month. Tracking progress keeps you accountable and allows for smart adjustments.

Recommended Savings Rates

Your savings rate depends on your financial goals. Common benchmarks include:

- **10% Rule** – Best for beginners

- **20% Standard** – Recommended by financial experts

- **30%+ Advanced** – For aggressive savers or high earners

- **Custom Rate** – Adjust based on your bonuses

If you're repaying debt, save a modest percentage while you reduce liabilities.

Increase Income with Extra Gigs

Raising your income is as effective as cutting costs. Consider these freelance options:

- **Freelancing** – Offer services on Upwork

- **Online Tutoring** – Teach via VIPKid

- **Selling Products** – Sell crafts or art on Etsy

- **Delivery or Rideshare** – Join Uber

- **Rent Assets** – List a room on Turo

Channel all extra income to savings to reach your goals faster.

Build Financial Protection

An emergency fund acts as a buffer during financial crises like job loss or medical bills.

Recommended Fund Size:

- **Start small** – $1,000 is a great beginning

- **Target** – 3–6 months of living expenses

- **Advanced** – 6–12 months for freelancers or those with dependents

Use a high-yield savings account to earn interest while keeping funds accessible.

Conclusion

Saving click here money from your salary is essential to reaching financial independence. By budgeting, setting goals, tracking your habits, and increasing your income, you position yourself for long-term success.

Be patient, be steady, and your finances will grow.

Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Atticus Shaffer Then & Now!

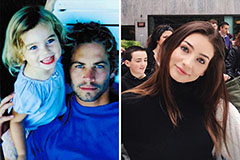

Atticus Shaffer Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!